| Western Asset Prem Inst Liquid Res Cap (WAAXX) | 5.04 |

| Morgan Stanley Inst Liq Prime MMP Inst (MPFXX) | 4.95 |

| State Street Inst Liq Reserve Prem (SSIXX) | 4.94 |

| BlackRock Lq TempCash Inst (TMCXX) | 4.92 |

| Federated Hermes Inst Prime Oblig IS (POIXX) | 4.90 |

| Morgan Stanley IL Liq MMP Wealth (MWMXX) | 5.00 |

| Allspring MMF Prm (WMPXX) | 4.97 |

| First American Ret Prime Obligs X (FXRXX) | 4.96 |

| Invesco Premier Institutional (IPPXX) | 4.96 |

| UBS Prime Preferred Fund (UPPXX) | 4.95 |

| Federated Hermes Muni Obligs WS (MOFXX) | 3.55 |

| Vanguard Municipal MMF (VMSXX) | 3.35 |

| Allspring Nat Tax-Free Prem (WFNXX) | 3.32 |

| Fidelity Inv MM: Tax Exempt I (FTCXX) | 3.30 |

| T Rowe Price Tax-Exempt MF I (TERXX) | 3.28 |

Money Market News

MORE NEWS »Last week, Federal Reserve Vice Chair for Supervision Michael Barr gave a speech entitled, "Supporting Market Resilience and Financial Stability," which suggested that regulators will be taking a harder look at uninsured bank deposits. He states, "[W]e have made important progress since last year's conference. The Securities and Exchange Commission has finalized a rule on central clearing of Treasury transactions, the Treasury Department has instituted a program for buying back less-liquid Treasury securities, and the Office of Financial Research is preparing for its permanent collection of data on non-centrally-cleared bilateral repurchase agreement (repo) transactions, which will support our understanding of this market segment as it evolves."

Inside Money Fund Intelligence

MFI PDF September 2024 Issue |

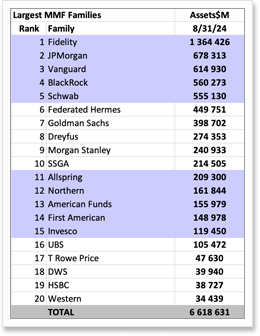

Largest Money Fund Managers |

|

|

The September 2024 issue of Money Fund Intelligence features: "SSGA, Columbia Stick with Prime Inst MMFs; Changes," which breaks down the latest news in the Prime Inst space; "MMFs Hit Record $6.68 Trillion; Falling Rates Driving Inflows," which covers the recent (and pending) asset surge; and, “More Scrutiny on Sweeps; Investment News, UBS," which follows the most recent news on brokerage sweeps. Each monthly issue of Money Fund Intelligence features news, performance information and rankings on money market mutual funds. Statistics include: assets, weighted average maturity, weighted average life, expense ratio, 7-day yield, 30-day yield, 1-year, 3-yr, 5-yr, 10-yr, and since inception return, as well as 7- and 30-day gross yields. MFI also contains tables of the top-yielding and the largest money funds, and our benchmark Crane Money Fund Indexes. Subscriptions are $500 a year, and include online access to archived issues and additional features. Bulk discounts and site licenses are available. Write info@cranedata.com or call 1-508-439-4419 to subscribe or to request more information. |

The table below is excerpted from our monthly spreadsheet product, Money Fund Intelligence XLS. It shows the largest money market mutual fund managers as of August 31, 2024. (MFI XLS contains percentile rankings, fund family rankings, MNAVs, WLA, portfolio composition, and more).

|

|

About Crane Data LLC

Crane Data is a money market and mutual fund information company founded by Peter G. Crane and Shaun Cutts. We collect money market mutual fund, bank savings, and cash investment performance, statistics, and information and distribute rankings, news, and indexes.

Crane Data publishes Money Fund Intelligence, Money Fund Intelligence XLS, Money Fund Wisdom, the Crane Money Fund Indexes, and a series of products tracking money markets, mutual funds and cash investments. We also produce conferences, including Crane's Money Fund Symposium. For more information and samples, e-mail info@cranedata.com or call us at 1-508-439-4419.

Link of the Day

MORE LINKS »

Sep 30

BlackRock TempCash Filing on Fees

A Prospectus Supplement for BlackRock Liquidity Funds' TempCash tells us, "The Securities and Exchange Commission ('SEC') approved new amendments to the rules governing money market funds in July 2023. Among the changes, the SEC adopted rules that require institutional prime and institutional tax‑exempt money market funds to apply a ...

Sep 24

WisdomTree Connect Launched

People

more »

Sep 17

Lotharius Joins Cavu Securities

Tony Lotharius recently joined Cavu Securities as a Managing Director - Cash Solutions. He was previously at State Street.

Aug 22

Berretta, Curtis Join Deep Blue

Money market veterans Fred Berretta and Fritz Curtis have joined Deep Blue Investment Advisors. Deep Blue is based in Florida and manages public funds or LGIPs (local government investment pools).

Aug 14

McColley Retires from Columbia

John McColley retired from Columbia Threadneedle Investments after almost 40 years of service. He is succeeded by Portfolio Manager Ryan Krieg. We wish John all the best in retirement!

Crane Data News & Features

contact us »Crane's Money Fund University 12/19-20

Thank you to those who supported our recent European Money Fund Symposium show in London! Mark your calendars for next year's event, which will be Sept. 25-26, 2025 in Dublin. We're now ramping up preparations for our Money Fund University, which will be held in Providence, R.I., Dec. 19-20, 2024. Mark your calendars too for our Bond Fund Symposium, which is scheduled for March 27-28, 2025 in Newport Beach, Calif., and for our next big show, Money Fund Symposium, which is scheduled for June 23-25, 2025 in Boston. Subscribers and attendees may access the recordings and conference materials (except for European MFS) via our "Content” page. Watch for more details on future shows in coming months, and let us know if you'd like more information. We hope to see you in Providence this December, or in Newport Beach in March, in Boston in June or in Dublin in September 2025!