| Federated Hermes Inst Prime Obligs IS (POIXX) | 3.73 |

| JPMorgan Prime MM Capital (CJPXX) | 3.73 |

| BlackRock Lq TempCash Inst (TMCXX) | 3.72 |

| Morgan Stanley Inst Liq Prime MMP Inst (MPFXX) | 3.71 |

| Western Asset Prem Inst Liq Res Capital (WAAXX) | 3.67 |

| Invesco Premier Institutional (IPPXX) | 3.74 |

| Morgan Stanley IL Liq MMP Wealth (MWMXX) | 3.74 |

| Allspring MMF Prm (WMPXX) | 3.73 |

| JPMorgan Liquid Assets Capit (CJLXX) | 3.72 |

| UBS Prime Preferred Fund (UPPXX) | 3.70 |

| Goldman Sachs Inv Tax-Ex MMF In (FTXXX) | 1.85 |

| Allspring Nat Tax-Free Prem (WFNXX) | 1.60 |

| Federated Hermes Muni Oblig WS (MOFXX) | 1.57 |

| Morgan Stanley Inst Liq T-E Wealth (TEWXX) | 1.56 |

| Schwab Municipal MF Ultra (SWOXX) | 1.48 |

Money Market News

MORE NEWS »Money fund yields (7-day, annualized, simple, net) decreased by 1 bp to 3.50% on average during the week ended Friday, January 23 (as measured by our Crane 100 Money Fund Index), after decreasing 2 bps the week prior. Fund yields haven't been below 3.5% since November 2022, and they are down from a recent high of 5.20% in November 2023. They should remain flat in coming days as the market expects the Fed to hold rates steady this week (and perhaps this year). Yields were 3.58% on 12/31/25, 3.78% on 11/30, 3.90% on 10/31, 3.94% on 9/30, 4.11% on 8/31, 4.12% on 7/31, 4.13% on 6/30, 4.14% on 3/31/25 and 4.28% on average on 12/31/24. MMFs averaged 4.75% on 9/30/24, 5.10% on 6/28/24, 5.14% on 3/31/24 and 5.20% on 12/31/23. The broader Crane Money Fund Average, which includes all taxable funds tracked by Crane Data (currently 681), shows a 7-day yield of 3.40%, down 1 bp in the week through Friday.

Inside Money Fund Intelligence

MFI PDF January 2026 Issue |

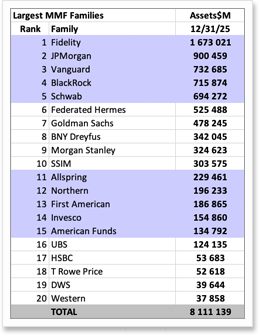

Largest Money Fund Managers |

|

|

The January 2026 issue of Money Fund Intelligence features: “Yields Drop to 3.6%; Assets Break Through $8.1 Trillion,” which discusses the decline in yields but continued jump in assets; “ICI: Worldwide MMFs Jump in Q3’25 to $12.7T; China $2T,” which looks at the latest MMF statistics outside the U.S.; and, “Top Money Funds of 2025; 17th Annual MFI Awards” which reviews the best performing MMFs of 2025. Each monthly issue of Money Fund Intelligence features news, performance information and rankings on money market mutual funds. Statistics include: assets, weighted average maturity, weighted average life, expense ratio, 7-day yield, 30-day yield, 1-year, 3-yr, 5-yr, 10-yr, and since inception return, as well as 7- and 30-day gross yields. MFI also contains tables of the top-yielding and the largest money funds, and our benchmark Crane Money Fund Indexes. Subscriptions are $500 a year, and include online access to archived issues and additional features. Bulk discounts and site licenses are available. Write info@cranedata.com or call 1-508-439-4419 to subscribe or to request more information. |

The table below is excerpted from our monthly spreadsheet product, Money Fund Intelligence XLS. It shows the largest money market mutual fund managers as of Dec. 31, 2025. (MFI XLS contains percentile rankings, fund family rankings, MNAVs, WLA, portfolio composition, and more).

|

|

About Crane Data LLC

Crane Data is a money market and mutual fund information company founded by Peter G. Crane and Shaun Cutts. We collect money market mutual fund, bank savings, and cash investment performance, statistics, and information and distribute rankings, news, and indexes.

Crane Data publishes Money Fund Intelligence, Money Fund Intelligence XLS, Money Fund Wisdom, the Crane Money Fund Indexes, and a series of products tracking money markets, mutual funds and cash investments. We also produce conferences, including Crane's Money Fund Symposium. For more information and samples, e-mail info@cranedata.com or call us at 1-508-439-4419.

Link of the Day

MORE LINKS »

Jan 27

Bond Fund Symposium Boston, 3/19-20

Crane Data is ramping up preparations for its ninth annual Bond Fund Symposium, a conference focused on ultra-short bond funds and ETFs, which will take place March 19-20, 2026 at the Hyatt Regency in Boston, Mass. Crane's Bond Fund Symposium offers a concentrated and affordable educational experience ...

People

more »

Dec 09

Thrivent Seeks Portfolio Manager

Thrivent is seeking a Senior Money Market Portfolio Manager in Minneapolis. The posting says, "The Money Market Portfolio Manager is responsible for the management of the organization’s 2(a)7 mutual funds and the overall management of the organization’s cash holdings across multiple accounts and portfolios."

Dec 03

Deutsche Hires Cassie von Sprecher

"Deutsche Hires von Sprecher" says a brief in the Securities Finance Times. It explains, "Deutsche Bank has appointed Cassandra von Sprecher as global head of agency securities lending sales." She was formerly with State Street and formerly Casandra (Cassie) Jones.

Oct 27

Berretta Joins Treasury Curve

"Treasury Curve Appoints Fred Berretta as Vice President of Partnerships to Accelerate Channel Growth," says a press release.

Crane Data News & Features

contact us »Bond Fund Symposium Boston, 3/19-20

Thank you to those who attended and supported our recent Money Fund University in Pittsburgh! Mark your calendars for next year’s show, which will be in Greenwich, Conn., Dec. 17-18, 2026. We’re now preparing for our ultra-short bond fund event, Bond Fund Symposium, which is scheduled for March 19-20 in Boston. Mark your calendars too for our next big show, Money Fund Symposium, which is June 24-26, 2026 in Jersey City, NJ, and for our next European Money Fund Symposium, which is Sept. 24-25 in Paris. Subscribers and attendees may access the recordings and conference materials (except for European MFS) via our "Content" page. Contact us and let us know if you'd like more information on any future (or past) shows. We hope to see you in Boston, Jersey City, Paris or Greenwich in 2026!