| Morgan Stanley Inst Liq Prime Inst (MPFXX) | 4.44 |

| Federated Hermes Inst Prime Obligs IS (POIXX) | 4.42 |

| JPMorgan Prime MM Capital (CJPXX) | 4.42 |

| BlackRock Lq TempCash Inst (TMCXX) | 4.40 |

| State Street Inst Liq Reserve Prem (SSIXX) | 4.34 |

| Morgan Stanley IL Liq MMP Wealth (MWMXX) | 4.45 |

| Allspring MMF Prm (WMPXX) | 4.44 |

| JPMorgan Liquid Assets Capit (CJLXX) | 4.41 |

| UBS Prime Preferred Fund (UPPXX) | 4.41 |

| Invesco Premier Institutional (IPPXX) | 4.40 |

| Goldman Sachs Inv Tax-Ex MMF In (FTXXX) | 2.79 |

| Federated Hermes Muni Oblig WS (MOFXX) | 2.78 |

| T Rowe Price Tax-Exempt MF I (TERXX) | 2.77 |

| Allspring Nat Tax-Free Prem (WFNXX) | 2.64 |

| Fidelity Inv MM: Tax Exempt I (FTCXX) | 2.64 |

Money Market News

MORE NEWS »S&P Global Ratings published "U.S. Domestic 'AAAm' Money Market Fund Trends (Fourth-Quarter 2024)" earlier this week, which tells us, "Similar to the prior quarter, rated MMF assets grew by roughly 7% in Q4 2024, driven by flows into government funds. Rated MMF assets grew 15% overall for 2024, with most of the growth occurring during the second half of the year. We observed a modest reduction in the level of institutional prime fund assets, largely following the latest SEC rule 2a-7 reforms going into effect. Despite numerous fund sponsors consolidating or eliminating their institutional prime offerings, rated prime fund assets only declined 2% year over year. Certain investors moved to government strategies, but others routed assets into the remaining existing prime funds, demonstrating a continued desire for a variety of liquidity tools."

Inside Money Fund Intelligence

MFI PDF January 2025 Issue |

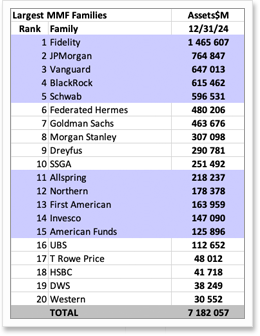

Largest Money Fund Managers |

|

|

The December 2024 issue of Money Fund Intelligence features: "Money Fund Assets Break Over $7.0 Trillion; Still Going," which reviews the continued jump in MMF assets; "Top 10 Stories of 2024: Asset Surge Continues, Yields Peak," which looks back at some of Crane Data’s top stories of the year; and, “BlackRock Files for Money Market ETFs: Will They Fly?," which looks at the new ETF filings. Each monthly issue of Money Fund Intelligence features news, performance information and rankings on money market mutual funds. Statistics include: assets, weighted average maturity, weighted average life, expense ratio, 7-day yield, 30-day yield, 1-year, 3-yr, 5-yr, 10-yr, and since inception return, as well as 7- and 30-day gross yields. MFI also contains tables of the top-yielding and the largest money funds, and our benchmark Crane Money Fund Indexes. Subscriptions are $500 a year, and include online access to archived issues and additional features. Bulk discounts and site licenses are available. Write info@cranedata.com or call 1-508-439-4419 to subscribe or to request more information. |

The table below is excerpted from our monthly spreadsheet product, Money Fund Intelligence XLS. It shows the largest money market mutual fund managers as of December 31, 2024. (MFI XLS contains percentile rankings, fund family rankings, MNAVs, WLA, portfolio composition, and more).

|

|

About Crane Data LLC

Crane Data is a money market and mutual fund information company founded by Peter G. Crane and Shaun Cutts. We collect money market mutual fund, bank savings, and cash investment performance, statistics, and information and distribute rankings, news, and indexes.

Crane Data publishes Money Fund Intelligence, Money Fund Intelligence XLS, Money Fund Wisdom, the Crane Money Fund Indexes, and a series of products tracking money markets, mutual funds and cash investments. We also produce conferences, including Crane's Money Fund Symposium. For more information and samples, e-mail info@cranedata.com or call us at 1-508-439-4419.

Link of the Day

MORE LINKS »

Feb 05

Weekly MF Portfolio Holdings

Crane Data published its latest Weekly Money Fund Portfolio Holdings statistics Tuesday, which track a shifting subset of our monthly Portfolio Holdings collection. The most recent cut (with data as of Jan. 31) includes Holdings information from 47 money funds (down 28 from a week ago), or $2.901 trillion ...

People

more »

Jan 21

Jon and Nick Higham Join Loop Capital

Jon Highum and Nick Highum have joined Loop Capital in fixed income sales. Jon previously served as sales manager at CastleOak, while Nick was previously with Mesirow.

Jan 14

Lou Bonnet Retiring from CIBC

Louis Bonnet, Head of US Money Markets - Financial Solutions Group, at CIBC World Markets Corp., will be retiring after 42 years. We wish Lou all the best in retirement!

Nov 22

DWS's Matt Plomin Passes Suddenly

We were stunned and saddened by the news that DWS Head of Money Market Credit Matt Plomin passed away suddenly last week. (See the Obituary here.) Our deepest condolences to the Plomin family and to his friends and colleagues at DWS.

Crane Data News & Features

contact us »Crane's Bond Fund Symposium 3/27-28

Thank you to those who attended our recent Money Fund University show in Providence! We hope you enjoyed the show.... Mark your calendars for next year's event, which will be Dec. 18-19, 2025, in Pittsburgh. We're now ramping up preparations for our Bond Fund Symposium, which will be held March 27-28 in Newport Beach, Calif. Mark your calendars too for our next Money Fund Symposium, which is scheduled for June 23-25 in Boston, and for our next European Money Fund Symposium, which is scheduled for Sept. 25-26 in Dublin. Subscribers and attendees may access the recordings and conference materials (except for European MFS) via our "Content” page. Watch for more details on future shows in coming months, and let us know if you'd like more information. We hope to see you in Newport Beach in March, in Boston in June, in Dublin in September or in Pittsburgh in December 2025!