| Morgan Stanley Inst Liq Prime MMP Inst (MPFXX) | 4.82 |

| BlackRock Lq TempCash Inst (TMCXX) | 4.72 |

| JPMorgan Prime MM Capital (CJPXX) | 4.72 |

| State Street Inst Liq Reserve Prem (SSIXX) | 4.71 |

| Western Asset Prem Inst Liq Res Cap (WAAXX) | 4.71 |

| Morgan Stanley IL Liq MMP Wealth (MWMXX) | 4.83 |

| First American Ret Prime Obligs X (FXRXX) | 4.75 |

| UBS Prime Preferred Fund (UPPXX) | 4.74 |

| Allspring MMF Prm (WMPXX) | 4.74 |

| Invesco Premier Institutional (IPPXX) | 4.74 |

| Federated Hermes Muni Obligs WS (MOFXX) | 2.89 |

| Allspring Nat T-F Prem (WFNXX) | 2.83 |

| Goldman Sachs Inv Tax-Ex MMF In (FTXXX) | 2.71 |

| T Rowe Price Tax Exempt MF I (TERXX) | 2.70 |

| JPMorgan Tax Free MM Inst (JTFXX) | 2.69 |

Money Market News

MORE NEWS »The November issue of our Bond Fund Intelligence, which will be sent to subscribers Friday morning, features the stories, "Bond Funds Hit by Election, But Still See Inflows," which reviews the latest statistics on the bond fund markets, and "ETF Trends on MM Substitutes, Ultra-Shorts," which covers recent news pertaining to cash and its possible substitutes. BFI also recaps the latest Bond Fund News and includes our Crane BFI Indexes, which show that bond fund returns fell in October while yields were higher. We excerpt from the new issue below. (Contact us if you'd like to see our latest Bond Fund Intelligence and BFI XLS spreadsheet, or our Bond Fund Portfolio Holdings data.) (Note: See also Bloomberg's "A $7 Trillion and Growing Cash Pile Defies Wall Street Skeptics.")

Inside Money Fund Intelligence

MFI PDF November 2024 Issue |

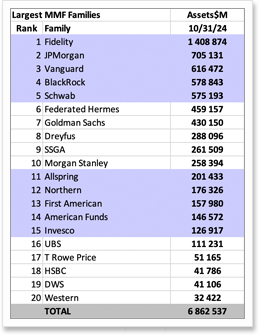

Largest Money Fund Managers |

|

|

The November 2024 issue of Money Fund Intelligence features: "Tokenized Money Funds Gain Momentum; Issues Remain," which reviews the latest releases and news on MMFs on the blockchain; "Federated Hermes, Schwab Earnings Calls Highlight MMFs," which quotes from recent earnings call MMF comments; and, “BNY, UBS Latest to Liquidate Municipal Money Funds," which recaps the thinning among Tax-Exempt Money Funds. Each monthly issue of Money Fund Intelligence features news, performance information and rankings on money market mutual funds. Statistics include: assets, weighted average maturity, weighted average life, expense ratio, 7-day yield, 30-day yield, 1-year, 3-yr, 5-yr, 10-yr, and since inception return, as well as 7- and 30-day gross yields. MFI also contains tables of the top-yielding and the largest money funds, and our benchmark Crane Money Fund Indexes. Subscriptions are $500 a year, and include online access to archived issues and additional features. Bulk discounts and site licenses are available. Write info@cranedata.com or call 1-508-439-4419 to subscribe or to request more information. |

The table below is excerpted from our monthly spreadsheet product, Money Fund Intelligence XLS. It shows the largest money market mutual fund managers as of October 31, 2024. (MFI XLS contains percentile rankings, fund family rankings, MNAVs, WLA, portfolio composition, and more).

|

|

About Crane Data LLC

Crane Data is a money market and mutual fund information company founded by Peter G. Crane and Shaun Cutts. We collect money market mutual fund, bank savings, and cash investment performance, statistics, and information and distribute rankings, news, and indexes.

Crane Data publishes Money Fund Intelligence, Money Fund Intelligence XLS, Money Fund Wisdom, the Crane Money Fund Indexes, and a series of products tracking money markets, mutual funds and cash investments. We also produce conferences, including Crane's Money Fund Symposium. For more information and samples, e-mail info@cranedata.com or call us at 1-508-439-4419.

Link of the Day

MORE LINKS »

Nov 15

ICI: MMFs Jump to Record $6.67 Trillion

ICI's latest "Money Market Fund Assets" report shows money funds surging $81.6 billion to a new record of $6.667 trillion in the latest week, after jumping $79.5 billion the previous week. Assets have risen in 12 of the last 15, and 23 of the last 30 ...

People

more »

Oct 02

Martello Joins Deutsche's DWS

Mark Martello has joined DWS, Deutsche Bank's asset management arm, as Relationship Manager - Head of Midwest Corporate Coverage. He was previously with Dreyfus.

Sep 17

Lotharius Joins Cavu Securities

Tony Lotharius recently joined Cavu Securities as a Managing Director - Cash Solutions. He was previously at State Street.

Aug 22

Berretta, Curtis Join Deep Blue

Money market veterans Fred Berretta and Fritz Curtis have joined Deep Blue Investment Advisors. Deep Blue is based in Florida and manages public funds or LGIPs (local government investment pools).

Crane Data News & Features

contact us »Crane's Money Fund University 12/19-20

Thank you to those who supported our recent European Money Fund Symposium show in London! Mark your calendars for next year's event, which will be Sept. 25-26, 2025 in Dublin. We're now ramping up preparations for our Money Fund University, which will be held in Providence, R.I., Dec. 19-20, 2024. Mark your calendars too for our Bond Fund Symposium, which is scheduled for March 27-28, 2025 in Newport Beach, Calif., and for our next big show, Money Fund Symposium, which is scheduled for June 23-25, 2025 in Boston. Subscribers and attendees may access the recordings and conference materials (except for European MFS) via our "Content” page. Watch for more details on future shows in coming months, and let us know if you'd like more information. We hope to see you in Providence this December, or in Newport Beach in March, in Boston in June or in Dublin in September 2025!