| Morgan Stanley Inst Liq Prime MMP Inst (MPFXX) | 4.82 |

| BlackRock Lq TempCash Inst (TMCXX) | 4.72 |

| JPMorgan Prime MM Capital (CJPXX) | 4.72 |

| State Street Inst Liq Reserve Prem (SSIXX) | 4.71 |

| Western Asset Prem Inst Liq Res Cap (WAAXX) | 4.71 |

| Morgan Stanley IL Liq MMP Wealth (MWMXX) | 4.83 |

| First American Ret Prime Obligs X (FXRXX) | 4.75 |

| Invesco Premier Institutional (IPPXX) | 4.74 |

| UBS Prime Preferred Fund (UPPXX) | 4.74 |

| Allspring MMF Prm (WMPXX) | 4.74 |

| Federated Hermes Muni Obligs WS (MOFXX) | 2.89 |

| Allspring Nat T-F Prem (WFNXX) | 2.83 |

| Goldman Sachs Inv Tax-Ex MMF In (FTXXX) | 2.71 |

| T Rowe Price Tax Exempt MF I (TERXX) | 2.70 |

| JPMorgan Tax Free MM Inst (JTFXX) | 2.69 |

Money Market News

MORE NEWS »Crane Data is making plans and preparing the agenda for our eighth annual ultra-short bond fund event, Bond Fund Symposium, which will take place March 27-28, 2025 at the Hyatt Regency in Newport Beach, Calif. Crane's Bond Fund Symposium offers a concentrated and affordable educational experience, as well as an excellent networking venue, for bond fund and fixed-income professionals. Registrations are now being accepted ($1,000) and sponsorship opportunities are available. We review the preliminary agenda and details below, and we also give the latest update on our upcoming "basic training" show, Money Fund University, which will be held next month in Providence, Dec. 19-20. (We'll also be hosting our Crane Data Holiday Party alongside MFU, so please join us Thursday, Dec. 19 from 5:00-7:30pm at the Renaissance Hotel in Providence.)

Inside Money Fund Intelligence

MFI PDF November 2024 Issue |

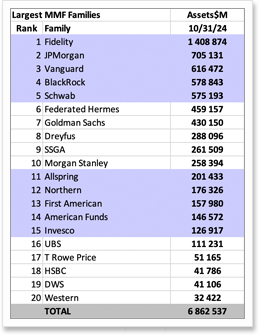

Largest Money Fund Managers |

|

|

The November 2024 issue of Money Fund Intelligence features: "Tokenized Money Funds Gain Momentum; Issues Remain," which reviews the latest releases and news on MMFs on the blockchain; "Federated Hermes, Schwab Earnings Calls Highlight MMFs," which quotes from recent earnings call MMF comments; and, “BNY, UBS Latest to Liquidate Municipal Money Funds," which recaps the thinning among Tax-Exempt Money Funds. Each monthly issue of Money Fund Intelligence features news, performance information and rankings on money market mutual funds. Statistics include: assets, weighted average maturity, weighted average life, expense ratio, 7-day yield, 30-day yield, 1-year, 3-yr, 5-yr, 10-yr, and since inception return, as well as 7- and 30-day gross yields. MFI also contains tables of the top-yielding and the largest money funds, and our benchmark Crane Money Fund Indexes. Subscriptions are $500 a year, and include online access to archived issues and additional features. Bulk discounts and site licenses are available. Write info@cranedata.com or call 1-508-439-4419 to subscribe or to request more information. |

The table below is excerpted from our monthly spreadsheet product, Money Fund Intelligence XLS. It shows the largest money market mutual fund managers as of October 31, 2024. (MFI XLS contains percentile rankings, fund family rankings, MNAVs, WLA, portfolio composition, and more).

|

|

About Crane Data LLC

Crane Data is a money market and mutual fund information company founded by Peter G. Crane and Shaun Cutts. We collect money market mutual fund, bank savings, and cash investment performance, statistics, and information and distribute rankings, news, and indexes.

Crane Data publishes Money Fund Intelligence, Money Fund Intelligence XLS, Money Fund Wisdom, the Crane Money Fund Indexes, and a series of products tracking money markets, mutual funds and cash investments. We also produce conferences, including Crane's Money Fund Symposium. For more information and samples, e-mail info@cranedata.com or call us at 1-508-439-4419.

Link of the Day

MORE LINKS »

Nov 26

Money Fund Yields Dip Lower to 4.45%

Money fund yields declined by 3 basis points to 4.45% on average during the week ended Friday, Nov. 22 (as measured by our Crane 100 Money Fund Index), after falling 9 bps the week prior. Yields are now reflecting the majority of the Federal Reserve's 25 basis point ...

People

more »

Nov 22

DWS's Matt Plomin Passes Suddenly

We were stunned and saddened by the news that DWS Head of Money Market Credit Matt Plomin passed away suddenly last week. (See the Obituary here.) Our deepest condolences to the Plomin family and to his friends and colleagues at DWS.

Oct 02

Martello Joins Deutsche's DWS

Mark Martello has joined DWS, Deutsche Bank's asset management arm, as Relationship Manager - Head of Midwest Corporate Coverage. He was previously with Dreyfus.

Sep 17

Lotharius Joins Cavu Securities

Tony Lotharius recently joined Cavu Securities as a Managing Director - Cash Solutions. He was previously at State Street.

Crane Data News & Features

contact us »Crane's Money Fund University 12/19-20

Thank you to those who supported our recent European Money Fund Symposium show in London! Mark your calendars for next year's event, which will be Sept. 25-26, 2025 in Dublin. We're now ramping up preparations for our Money Fund University, which will be held in Providence, R.I., Dec. 19-20, 2024. Mark your calendars too for our Bond Fund Symposium, which is scheduled for March 27-28, 2025 in Newport Beach, Calif., and for our next big show, Money Fund Symposium, which is scheduled for June 23-25, 2025 in Boston. Subscribers and attendees may access the recordings and conference materials (except for European MFS) via our "Content” page. Watch for more details on future shows in coming months, and let us know if you'd like more information. We hope to see you in Providence this December, or in Newport Beach in March, in Boston in June or in Dublin in September 2025!